Contents

Domestic prices did not decline like their international counterparts owing to weakened INR against USD. If USD/INR continues to trade with gains in the upcoming sessions, then we may witness a rise in the prices of Bullion metals. Sarath Chandra Reddy had been arrested by the country’s federal financial crime agency, the drugmaker said in an exchange filing on Thursday. The issue had received a good response from investors both the institutional as well as Retail side, and the current GMP is 70 i.e. ~ 32% over its issue price. Therefore, we advise investors to lock in listing gains and only aggressive investors should consider making a long-term commitment to the company. DAX weekly technical forecast for 13 to 17 june 2016 DAX this week closed with loss.

Dax future after breakdown below 9999 support given low up to 9737, and heading towards my given tgts 9525 and 9000. The bulk of US stock indices were based on a price index. Yet, a performance-based calculation like the German stock market index DAX has been adopted by many significant Europeans. Thus, the DAX, a benchmark of 30 blue-chip companies in Germany, quotes the price of reinvested dividends. This can make investors confused when comparing headline prices between different countries. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets.

Trend trading can be reasonably labour intensive with many variables to consider. The list of pros and cons may assist you in identifying if trend trading is for you. The highs and lows of this opening time frame are taken as support and resistance and the basic rule is essentially very simple. Yen Yee is a writer and DIY investor with an interest in growing her stock portfolio over time.

This amount is decided by the exchange and varies from time to time. A mathematics teacher-turned-options trader, mainly a seller, PR Sundar shares his mantra of success. Oil prices fell for a fourth day on Thursday on concerns that new COVID curbs in China, the world’s biggest crude importer, will impact fuel demand. Brent crude futures fell 34 cents, or 0.4%, to $92.31 a barrel at 0115 GMT.

Which broker offer DAX ETFs?

Bloomberg’s Nejra Cehic breaks down the day’s trading on “Bloomberg Markets.” A Contract for Difference is a contract for a given good made between a buyer and a seller. At the conclusion of the deal, the vendor agrees to pay the buyer the price difference between the present price and the price. This means that you are aiming to benefit from the movement of an index when you exchange CFDs on indexes – instead of trading in the index itself.

Derivatives of indices — which comprise a pool of stocks — do not tend to move that violently. Zerodha CEO Nithin Kamath had in January 2022 taken to Twitter that only one percent of active traders beat FDs over three years. This is why an option buyer has limited liability — in the form of the premium paid — but an option seller has potentially unlimited losses. An option seller — also known as an option writer — makes money in four out of five possible outcomes, contrary to an option buyer who makes it in just one. Simple and easy to understand, Going practical in each module. Basics, tools, strategy and secret sauce at the end of…

Market Movers

Not all trades will work out this way, but because the trend is being followed, each dip caused more buyers to come into the market and push prices higher. In conclusion, identifying a strong trend is important for a fruitful trend trading strategy. Entry points are usually designated by an oscillator and exit points are calculated based on a positive risk-reward ratio. Using stop level distances, traders can either equal that distance or exceed it to maintain a positive risk-reward ratio e.g. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. Trend trading is a simple forex strategy used by many traders of all experience levels.

Despite the fact that the DAX index chart cannot fully be considered an indicator of the German economy, the companies whose shares are included in it represent a significant part of it. They and, accordingly, the index itself, in one way or another, reflect the general market trends. “Option selling can be done with a capital as low as Rs 25,000. It all depends on whether you are a part-time or full-time trader, your risk appetite and your return expectation etc.,” he said. An option seller must deposit margin money based on the contract’s value as collateral, which is much more than what a buying counterpart must pay.

It is the responsibility of the Client to ascertain whether he/she is permitted to use the services of the Global FT Market brand based on the legal requirements in his/her country of residence. The Germany 30 chart above depicts an approximate two year head and shoulders pattern, which aligns with a probable fall below the neckline subsequent to the right-hand shoulder. In this selected example, the downward fall of the Germany 30 played out as planned technically as well as fundamentally. Towards the end of 2018, Germany went through a technical recession along with the US/China trade war hurting the automotive industry. Brexit negotiations did not help matters as the possibility of the UK leaving the EU would most likely negatively impact the German economy as well. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea.

Pramod sir is an experienced person in Markets gives accurate advisory services. FXU Solutions Limited is incorporated in St. Vincent & the Grenadines as an International Broker Company with the registration number 26180BC2021. To suit you, we deliver the industry’s leading MetaTrader 5 trading platforms on your PC, Mac, smartphone or phone. PwC checks FXU’s performance data, including quotation, slippage, and order execution.

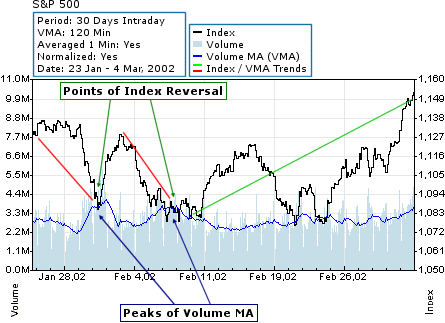

The DAX index of Germany’s 30 biggest companies was up 3.4 per cent at 9.30 am , after Monday’s solid gains. Notice too that both the MACD and RSI have been providing negative divergences to the rise in price, possibly signaling a reversal. Follow and observe the results for some days using paper trading or if you are advanced, you may want to back test these on a system like Ami broker. If the opening range is too wide, better do not trade ORB, since the Stops will be very far in the system. Opening range breakout happens after brief period of consolidation. When the 5 min candle closes below the 20 EMA in the case of longs and vice versa for sells.

In addition, DAX 30 depends on the global political environment, domestic and foreign policies of your country, as well as on the general state of its economy. The TR version reflects the theoretical income of the investor, and the PR version directly reflects the growth of the German economy. There is high correlation https://1investing.in/ between them, but the DAX live TR chart is slightly different from the DAX PR. Significant fluctuations in the quotes of individual stocks that make up the index. Due to the relatively small number of securities included in the index, fluctuations in the rate of any of them may change the value of the index as a whole.

DAX : Huge downside possible (Elliott Wave Analysis) 5th June, 2018 onwards

An option buyer, on the other hand, only has to pay the premium for the option upfront and not the full price of the contract. “So it may be appropriate to say that the option seller has 80 percent probability of winning, contrary to the option buyer, who only has 20 percent,” he said in an interview to CNBCTV18.com. I start teaching from the basics (it’s very important to understand the fundamentals so that the rest is smooth sailing) and… I have in my tools very precise technical patterns and money management that I will share with you. I have also developed my own investment training and coaching company, TNG Institute. After training in the trading room, working in a bank and completing a Master’s degree in finance, I started my own trading business.

- Entry and exit points can be judged using technical analysis as per the other strategies.

- Pramod sir is an experienced person in Markets gives accurate advisory services.

- Realty firm Prestige Estates Projects reported an 80 per cent increase in its consolidated net profit at Rs 140.7 crore in the September quarter of this fiscal year.

- Sundar identifies himself as an option seller, not a buyer.

- By analyzing the movement of the German market, you can understand what news will play at the opening of the US stock exchange.

Indian analyst in the field of trading in the forks and binary options markets. Writing about the successes and failures of banks, investment companies, and major traders. Stories about fraudulent schemes in investing and market news.

The DAX Live Chart shows the index quotes in real time and allows you to analyze them using major technical indicators. I based my strategy on the Lagging Span 2 line in the Ichimoku Cloud. I actually designed the strategy for the DAX Germany index 3 Minutes period, but you can use it on any instrument you want. I would like to point out some points that you should pay attention to when optimizing the strategy for the instrument you want to use. “Teaching is not a lucrative job. Moreover, I have already spent 20 years in teaching, and so have turned to trading even though they seem unrelated,” said Sundar, who has a trading portfolio of Rs crore.

Securities Transaction Tax on Intraday Trading: STT On Shares

Dax weekly chart price trend and momentum is very bearish. Efiling Income Tax Returns is made easy with ClearTax platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from Ripple Price Predictions in 10 Years salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

Asian markets soared in Tuesday trading, led by a stunning 13 percent jump in Tokyo. Traders use the same theory to set up their algorithms however, without the manual execution of the trader. When you see a strong trend in the market, trade it in the direction of the trend.

The volatility of DAX 30 share price and index is moderate. The change in its value per trading day is on average from 1% to 4%. At the same time, the liquidity of futures on the index is quite high, since it is one of the main European indicators, and futures contracts for it are in the top 5 in popularity among similar instruments. Sharing one more strategy after getting good feedback on my earlier published strategy.

Sundar identifies himself as an option seller, not a buyer. However, he buys option as part of his strategy, such as a ratio spread. The Bears were on the controlling side in the index throughout the day, however, the bull came in the last hour and managed to close above the crucial support zone of 41,500-41,400. To continue the strong momentum on the upside, the bulls must close the index above 42,000 where the highest open interest is built up on the call side. The bears will have complete control if the index breaks the level of 41,000 on the downside. Aug. 9 — European stocks closed higher with a gain of nearly one percent on the Stoxx 600 as every industry group finished in positive territory.

What factors affect the DAX Index today?

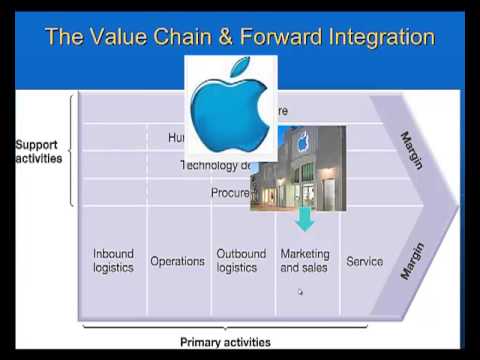

Trend trading attempts to yield positive returns by exploiting a markets directional momentum. Most of the businesses included in the DAX are also listed on the US stock exchanges. Everyone knows that the trading day of the EU market starts earlier due to the time difference. By analyzing the movement of the German market, you can understand what news will play at the opening of the US stock exchange. An important event unfolding in the market now is the ending of the lock-in period of some new-age tech companies. Some of the initial investors in these famous start-ups, who invested early at low prices, may choose to exit.

Most of the indices are regarded as a tool for assessing the state of the economy of a country. Such indices are the British FTSE and Japanese Nikkei 255. In almost all cases, the growth of their values indicates a favorable situation in the national economy.