Hence it is very important to check and compare the spread and commission incurred by the broker and their trade execution method. Spreads also depict the liquidity in the market of the underlying asset. Wider spreads mean low liquidity while narrow spreads denote high liquidity.

Deriv Group to launch Deriv Prime at IFX EXPO Cyprus 2023 – GlobeNewswire

Deriv Group to launch Deriv Prime at IFX EXPO Cyprus 2023.

Posted: Wed, 13 Sep 2023 08:00:00 GMT [source]

Hence, if you buy a currency pair and sell it immediately, you are at no loss. Additionally, it’s well known that liquidity can dry up and spreads can widen in the lead up to major news events and in between trading sessions. Forex traders use Pip to define the smallest change in value between two currencies. This is represented by a single digit move in the fourth decimal place in a typical forex quote. Also, keep in mind that the higher the spread, the smaller the profit margin you will have for each unit that you are buying. Conversely, the tighter the spread the more money you can make off of your investment.

What is Spread in Forex? FAQ

So when a broker claims “zero commissions” or “no commission”, it’s misleading because while there is no separate commission fee, you still pay a commission. This is why the terms “transaction cost” and “bid-ask spread” are used interchangeably. Where there is an efficient market – such as forex – with a lot of people both wanting to buy and sell in equal amounts, that gap will be very small. With the business point of view, brokers have to make money against their services.

- If you buy a spread, you believe that the spread between two prices will widen.

- Fibonacci strategy in forex trading is an attempt to profit by trading from the key price levels by using the Fibonacci sequence.

- Spreads can also be constructed in financial markets between two or more bonds, stocks, or derivatives contracts, among others.

- To calculate the spread of a financial instrument, you subtract the bid (buy) price from the ask (sell) price.

- Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake.

In order to make a profit, it will need to buy your iPhone at a price lower than the price it’ll sell it for. As the spread is based on the last large number in the price quote, it equates to a spread of 1.0. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Stay on top of upcoming market-moving events with our customisable economic calendar. Discover the range of markets you can trade on – and learn how they work – with IG Academy’s online course.

How Currencies Are Quoted

Optionally, you can even hold on to Spread-widening until it becomes tighter or narrowed. The reason is the lack of traders resulting in diminished liquidity. However, the scenario would not exist during a regular trading session. Spread is always the major source of revenue for forex and CFD brokers. A market maker generally offers a narrower spread than ECN/STP brokers but there can be exceptions.

Our goal is to give you the best information possible on how online trading works. No information or other content on this site should be considered as strategic investment advice. Such brokers buy large positions from liquidity providers and then offer those positions in small portions to the retail traders.

Why does the spread change in forex?

The message of requote will be displayed on your trading screen to inform you that the price has moved and if you agree to accept the new price or not. Knowing how to work with the spread allows you to make more informed trade decisions in any timeframe. My current position is a sell order, as I predict the market will fall.

In just a fraction of a second, your spread could be substantially higher or lower than you thought, which could have a huge overall impact on your bottom line. All spreads can be calculated by looking at the per-pip value of a trade and the number of lots that you are trading. Therefore, when we say that the bid price is the “buy” https://1investing.in/ price, we mean that it is the price at which the broker is willing to buy forex from you. It is, therefore, the price at which you can expect to sell your own currency. If you’re new to forex, we recommend downloading our free beginners forex trading guide which provides expert tips and insights on the market and ways to trade.

What Does a Forex Spread Tell Traders?

The bid-ask spread is the difference between the price a broker buys and sells a currency. So, if a customer initiates a sell trade with the broker, the bid price would be quoted. If the customer wants to initiate a buy trade, the ask price would be quoted. The bid represents the price at which the forex market maker or broker is willing to buy the base currency (USD, for example) in exchange for the counter currency (CAD).

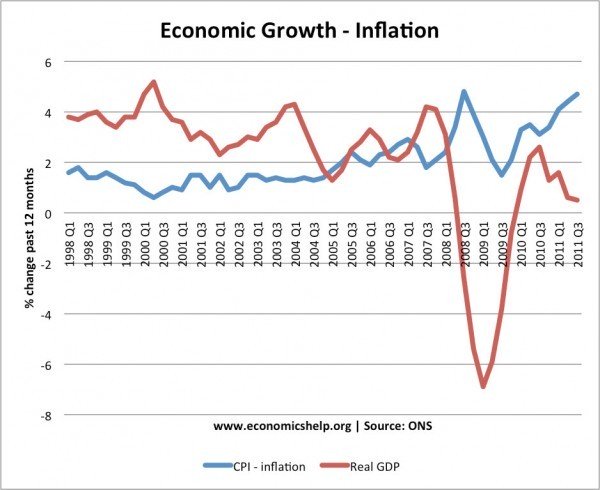

In general, spreads are typically wider when the market is volatile. So it would suggest that if volatility seems high, it may be time to look for opportunities to buy or sell the currency in question. Spread is crucial because it can influence the profits and losses made on forex trading. Lower or narrower spreads also increase the probability of making profits in forex trading.

In one of the most common definitions, the spread is the gap between the bid and the ask prices of a security or asset, like a stock, bond, or commodity. Spreads can also be constructed in financial markets between two or more bonds, stocks, or derivatives contracts, among others. Floating spreads can change based on exchange rate movements in the FX market. That being said, a key disadvantage of variable spreads is that you can end up entering a trade at a completely different spread than you thought.

Moreover, the broker can’t widen the spread during volatile market conditions or rapid price changes. Thus, under most requote circumstances, the price is worse than the order. Another disadvantage of Fixed Spread is Slippage, i.e., a broker’s inability to maintain a fee after the trader enters as it differs from the entry price. Forex trading is all about exchanging one currency for another with the motive of profiting.

Spreads are often priced as a single unit or as pairs on derivatives exchanges to ensure the simultaneous buying and selling of a security. Doing so eliminates execution risk wherein one part of the pair executes but another part fails. As we have mentioned, bid and ask prices assume that the price “taker” is you, the trader, and that the trade is done from the perspective of the broker. Therefore, the ask price determines the price at which the forex broker is willing to sell you the base currency in a given forex pair.

In the simple words, the spread depends on market liquidity of a given financial instrument i.e., the higher the turnover of a particular currency pair, the smaller the spread. For example, EUR/USD pair is the most traded pair; therefore, the spread in the EUR/USD pair is the lowest among all other pairs. Then there are other major pairs like USD/JPY, GBP/USD, AUD/USD, NZD/USD, USD/CAD, etc. In the case of exotic pairs, the spread is multiple times larger as compared to the major pairs and that’s all because of thin liquidity in exotic pairs.

Due to the above points, forex traders can employ an event-driven strategy based on macroeconomic indicators, in order to trade the tightest forex spreads and profit from opportune moments. For example, by monitoring the latest trading news and economic announcements, traders can expect changes in the forex market and find suitable entry and exit points when opening a position. One of the downsides of a variable spread is that, if the spread widens dramatically, your positions could be closed or you’ll be put on margin call. Keep an eye on our economic calendar to stay abreast of upcoming financial events. We want to clarify that IG International does not have an official Line account at this time. We have not established any official presence on Line messaging platform.

To figure out the total cost, you would multiply the cost per pip by the number of lots you’re trading. Typically, spreads widen during economic data releases as well as other periods when the liquidity in the market decreases (like during holidays and meaning of debit memo when the zombie apocalypse begins). Currency pairs involving the Japanese yen are quoted to only 2 decimal places (unless there are fractional pips, then it’s 3 decimals). Note, while margin can magnify your profits, it will also amplify any losses.

Such brokers get their price quotes of currency pairs from many liquidity providers and theses brokers pass the prices directly to the traders without any intervention of a dealing desk. It means that they have no control over the spreads and spreads will increase or decrease depending on overall volatility of the market and supply and demand of currencies. Forex trading or FX trading is the act of buying and selling currencies at their exchange rates in hopes that the exchange rate will move in the investor’s favor.