The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system. The https://www.instagram.com/bookstime_inc primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation. It is based on the idea that each transaction has an equal effect. It is used to transfer totals from books of prime entry into the nominal ledger.

- In above example, we have observed the impact of twelve different transactions on accounting equation.

- The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations.

- For example, the bankruptcy of Toys “R” Us in 2017 was partly due to its unsustainable debt burden.

- On 10 January, Sam Enterprises sells merchandise for $10,000 cash and earns a profit of $1,000.

- If an accounting equation does not balance, it means that the accounting transactions are not properly recorded.

- Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners.

What is the accounting formula?

This includes expense reports, cash flow and salary and company investments. The financial statement that uses the expanded accounting equation is the balance sheet. The expanded accounting equation provides a more detailed breakdown of the balance sheet’s components, including assets, liabilities, and equity. Firms can get the data for total assets and total liabilities from the balance sheet which they can then use further in the accounting equation to determine the equity. Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit).

Statement of Owner’s Equity

Hence, as of January 15, only three accounts exist with a balance – Cash, Furniture A/C, and Service Revenue (the rest get net off during the period of the whole transaction by January 15). Only those accounts that exist with a balance (positive or negative) on a particular date are reflected on the balance sheet. Due within the year, current liabilities on a balance sheet include accounts payable, wages or payroll payable and taxes payable. Long-term liabilities are usually owed to lending institutions and include notes payable and possibly unearned revenue. The purpose of the accounting equation is that it lays the framework for the accounting processes and ensures integrity in financial transaction recording.

- This shows all company assets are acquired by either debt or equity financing.

- Let us understand the different components of the equation in detail which will facilitate in understanding the calculation done by companies.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- Shareholder Equity is equal to a business’s total assets minus its total liabilities.

- It borrows $400 from the bank and spends another $600 in order to purchase the machine.

Module 4: Financial Statements of Business Organizations

- The accounting equation is a fundamental concept in finance that every private equity professional, investment banker, and corporate finance expert should be familiar with.

- The major and often largest value assets of most companies are that company’s machinery, buildings, and property.

- By analyzing the changes in assets, liabilities, and owner’s equity over time, stakeholders can identify trends, detect potential issues, and make informed decisions.

- This principle ensures that the Accounting Equation stays balanced.

- So whatever the worth of assets and liabilities of a business are, the owners’ equity will always be the remaining amount (total assets MINUS total liabilities) that keeps the accounting equation in balance.

- Any discrepancies between recorded assets and the sum of equity and liabilities signal an anomaly and a need for corrections in account balances.

- Since Speakers, Inc. doesn’t have $500,000 in cash to pay for a building, it must take out a loan.

This transaction brings cash into the business and also creates a new liability called bank loan. https://www.bookstime.com/ On 10 January, Sam Enterprises sells merchandise for $10,000 cash and earns a profit of $1,000. As a result of this transaction, an asset (i.e., cash) increases by $10,000 while another asset ( i.e., merchandise) decreases by $9,000 (the original cost). On the other side of the equation, a liability (i.e., accounts payable) is created. Creditors have preferential rights over the assets of the business, and so it is appropriate to place liabilities before the capital or owner’s equity in the equation. It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities.

It plays a crucial role in preparing financial statements that enables analyzing a firm’s financial health while ensuring transparency in accounting processes. Here we see that the sum of liabilities and equity equals the total assets and the equation balances. Evaluating the accounting equation can provide valuable insights into a company’s financial health and performance. By analyzing the changes in assets, liabilities, and owner’s equity over time, stakeholders can identify trends, detect potential issues, and make informed decisions.

- On 1 January 2016, Sam started a trading business called Sam Enterprises with an initial investment of $100,000.

- Debits and Credits are the words used to reflect this double-sided nature of financial transactions.

- All of our content is based on objective analysis, and the opinions are our own.

- So, let’s take a look at every element of the accounting equation.

- It is seen that the total credit amount equals the total debt amount.

- If a company keeps accurate records using the double-entry system, the accounting equation will always be “in balance,” meaning the left side of the equation will be equal to the right side.

What is the difference between an asset and a liability?

Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. The accounting equation is also called the basic accounting equation or the balance sheet equation. A double-entry bookkeeping system helps us understand the flow of any particular transaction from the source to the end. Equity denotes the value or ownership interest on residual assets that an organization’s owner or shareholders would receive if all liabilities were paid.

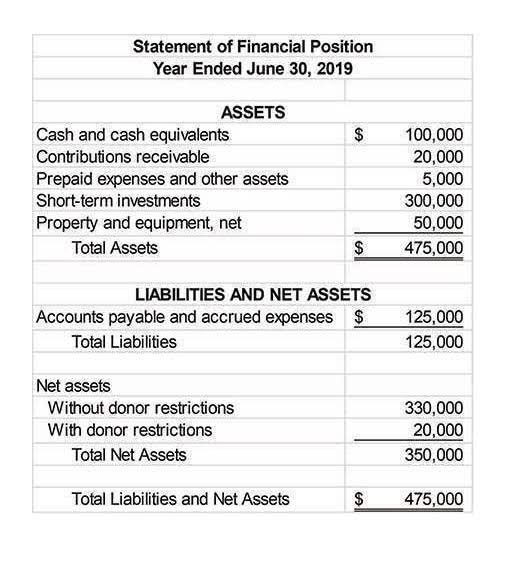

If assets increase, either liabilities or owner’s equity must increase to balance out the equation. They include cash on hand, cash at banks, investment, inventory, accounts receivable, prepaid, advance, fixed assets, etc. The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such accounting equation assets liabilities equity as December 31. The balance sheet is also referred to as the Statement of Financial Position. Balance sheets give you a snapshot of all the assets, liabilities and equity that your company has on hand at any given point in time.